Emotional acceptance of risk

It’s well known that the only thing you can really control in trading is the amount of risk you take. But can we accept the risk we take? Managing risk is basically a technical matter: you can use a stop order, you can hedge with an option, or the size of the option position itself […]

Margin requirements

A margin account is a type of investment account that allows an investor to borrow money from the brokerage firm to purchase securities. This additional buying power is known as leverage, and it can amplify returns in the account. Margin accounts also enable short selling, which is the ability to sell a security that the […]

Volatility strategies

Options trading can be a powerful tool for making money with volatility skew. Volatility skew refers to the difference in implied volatility between options with different strike prices or expiration dates. Understanding and taking advantage of volatility skew can be a profitable strategy for options traders. One way to make money with volatility skew is […]

Volatility skew

Volatility skew refers to the difference in implied volatility between different strike prices of options contracts for the same underlying asset. This difference in volatility can take on various forms, and understanding these forms can be important for making informed trading decisions. In this article, we will discuss the different types of volatility skews, including […]

Options as investments

Options trading can be a powerful tool for investors and traders looking to enhance returns, generate income, or hedge against potential losses in other investments. However, options trading is also complex and carries its own set of risks, making it important for investors and traders to have a solid understanding of how options fit into […]

Options trading FAQ

What is options trading about Options trading is the practice of buying and selling options contracts. Options contracts are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock, commodity, or currency, at a specific price (strike price) within a certain period […]

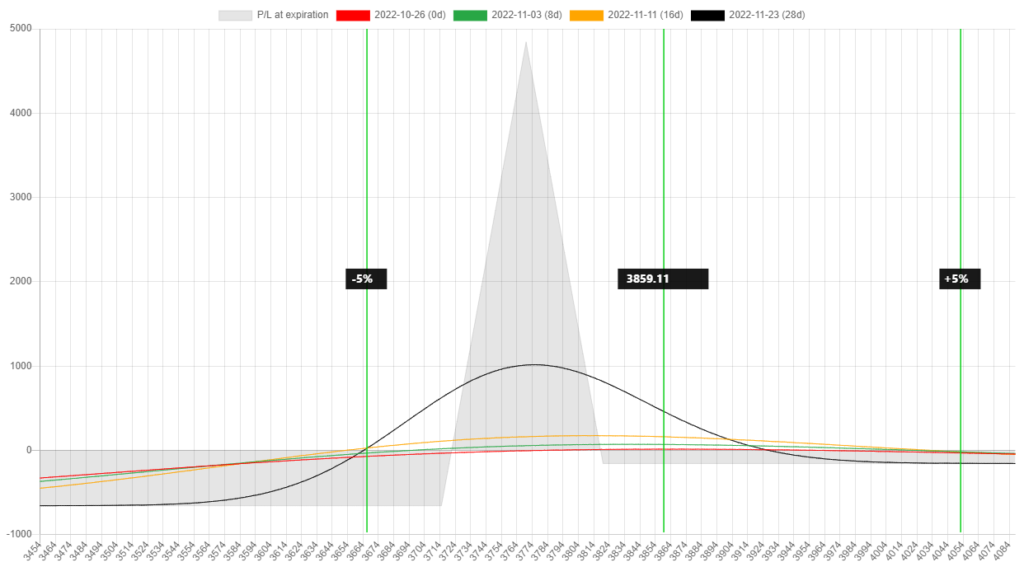

Flat SPX Put BWB

I like to trade broker-wing butterflies (BWB) because if it is positioned well, it can be quite a delta-neutral and positive theta trade. There are many underlyings you can trade BWBs on, but I particularly like SPX, SPY, and some other big tech names with higher stock prices. In this article, I would like to […]

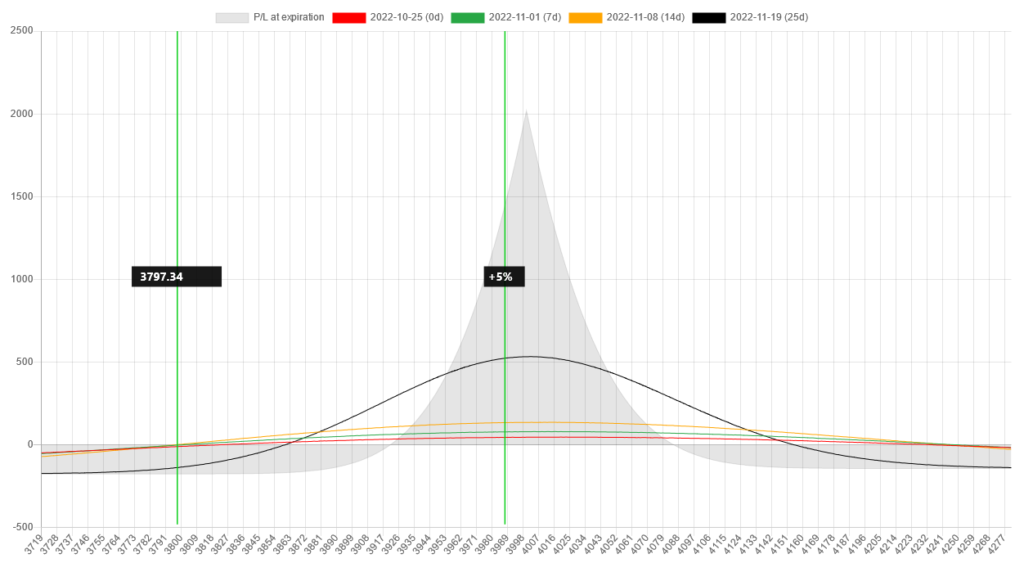

SPX 0 DTE Butterflies

0 DTE stands for strategies that expire on the day of opening them, hence there is 0 day to expiration. The most popular underlying for these strategies are SPY and SPX. I like SPX better because more strikes are available to build the strategy. In this article, I would like to show you how I […]

Cheap SPX call calendars

In this article, I would like to show you how to scan (and be alerted) for cheap SPX calendar spreads. Let’s assume, that I am looking for a call calendar spread because I think that SPX will rise in the next 2-3 weeks. Right now SPX has option expirations every single day. So sometimes there […]

Top features of NinjaSpread

There are two main goals of the scanner: show you hidden opportunities and save a lot of time with automated scanning. Let’s see what the top features are and how NinjaSpread can help your trading life. Find the best spread combinations No matter if you are looking for spreads in a single ticker or a […]