Option Strategy & GEX Visualization on TradingView

We’re thrilled to announce a significant new feature in NinjaSpread, one that’s set to elevate how options traders visualize and analyze their strategies. With this update, we’ve integrated TradingView’s robust charting tools directly into NinjaSpread, enabling dynamic visualizations that bring clarity to even the most complex strategies. Why Strategy Visualization Matters in Options Trading In […]

Jade Lizard Options Scanner

Options trading is a sophisticated arena where strategy and timing converge to create profit opportunities. For traders navigating high implied volatility (IV) environments with a neutral to bullish outlook, the Jade Lizard strategy emerges as a compelling choice. We’re excited to introduce the Jade Lizard Options Scanner on NinjaSpread—a powerful tool designed to help you […]

Introducing Metrics: Unveiling Advanced Option Insights

At NinjaSpread, we continuously strive to empower our subscribers with cutting-edge tools and comprehensive data to enhance their trading strategies. Today, we are thrilled to introduce Metrics, a groundbreaking feature designed to provide in-depth analysis and unparalleled visibility into stocks and ETFs. Metrics is now available as a dedicated subpage within NinjaSpread, offering four distinct […]

Direct Analysis with OptionStrat

We are excited to announce a powerful new feature in NinjaSpread, aimed at making your options strategy analysis even easier. You can now instantly analyze any scan result directly using OptionStrat’s free interface. This new integration removes the need to manually copy the trade details into other platforms like Thinkorswim, making the entire process more […]

Double Calendar / Diagonal Scanner

We’re excited to announce the release of the NinjaSpread Double Spread Scanner, a powerful tool designed to streamline your options trading strategy by providing a highly customizable approach to searching for double diagonal and double calendar spreads. Whether you’re an advanced options trader looking to enhance your spread strategies or just starting out, this new […]

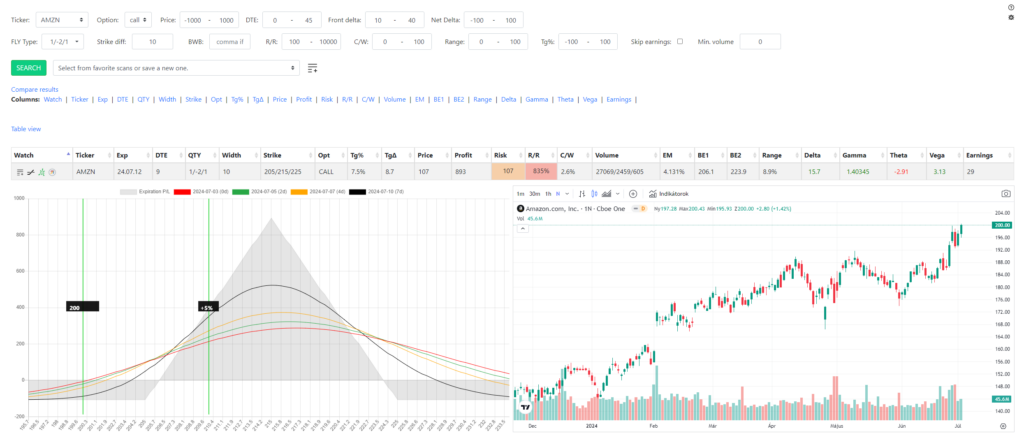

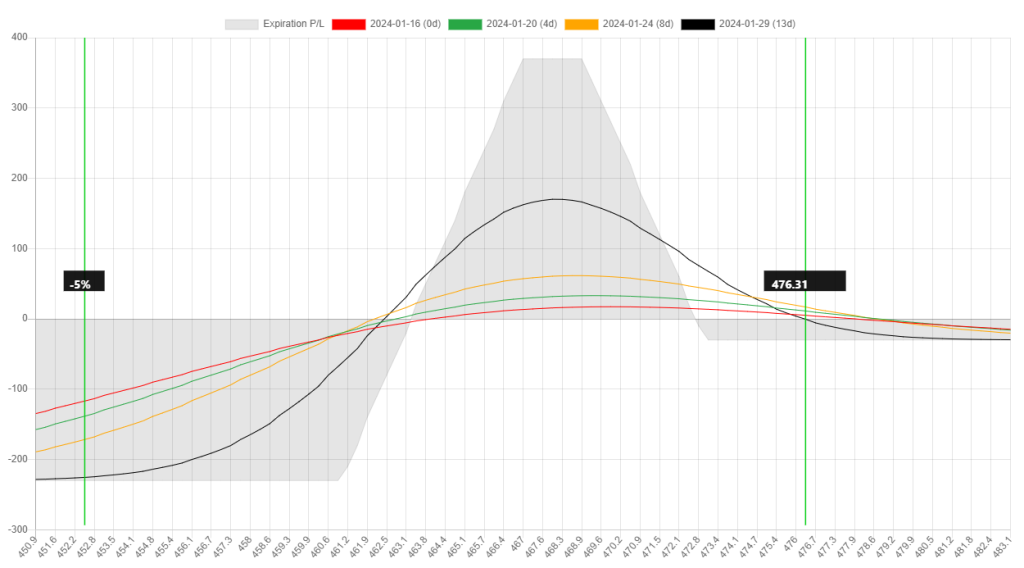

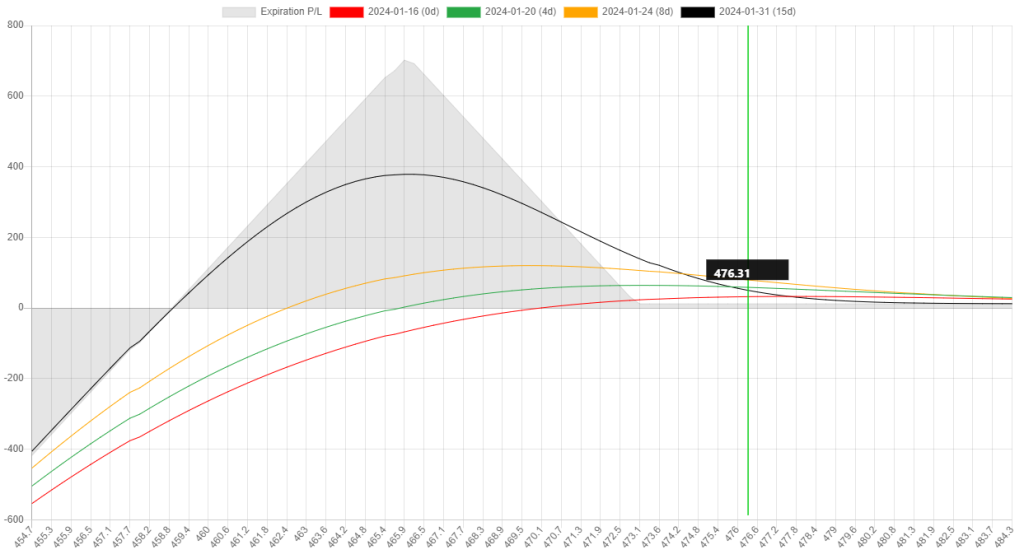

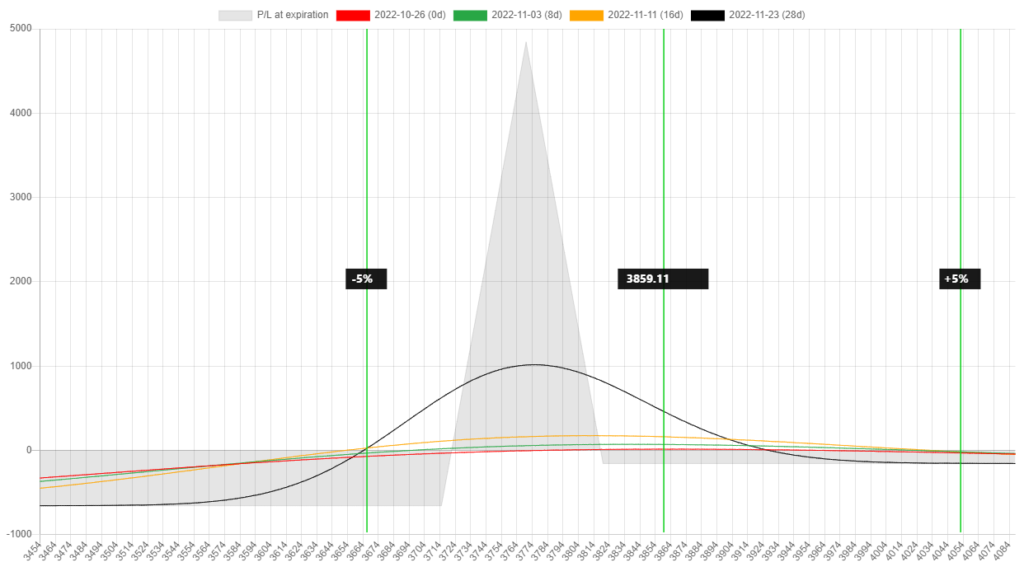

New Analyze & Chart View

We are excited to announce a significant enhancement to NinjaSpread that will take your options trading analysis to the next level. We’ve added an Analyze & Chart View that offers a comprehensive visual representation of each strategy’s performance, making it easier than ever to evaluate potential trades. What’s New? Previously, NinjaSpread provided a detailed search […]

Custom Condor Scanner

NinjaSpread has recently introduced an array of new features in its Condor scanner, aimed at enhancing the trading experience for those dealing with options, particularly Iron Condors and Broken Wing Condors. Here’s a detailed look at these new functionalities. Symmetrical and Asymmetrical The upgraded scanner now allows users to search for both symmetrical Iron Condors […]

Custom Ratio Spread Scanner

The Ninja Spread’s latest update introduces a powerful new tool for options traders – the Custom Ratio Spread Scanner. This innovative feature is designed to simplify and streamline the process of identifying and analyzing ratio spreads. Here’s an overview of the key new features and functionalities that this tool brings to the table. Enhanced Spread […]

Delta based Butterfly scanner

Introducing Our Latest Features NinjaSpread, renowned for its powerful and user-friendly tools for options spread scanning, is excited to introduce its latest feature set. This update is designed to provide a more comprehensive and tailored experience for traders and investors, offering a new level of customization and precision in managing options spreads. With the new […]

Historical bear markets

Let’s look at how long and frequent the years of losses in the US stock market have been in the past. Let’s start the review with the recent past, the last 22 years. I’m going to look at the S&P500 in the recent past, but if you really want to look back in time, you […]