In this case study, I want to share a recent SPX options trade in which I combined Calendar and Diagonal spreads. The idea behind such a hybrid trade is to benefit from certain expected price movements and time decay, while maintaining some flexibility to adjust or partially close positions as market conditions evolve. My initial assumption was that the market might stall or move sideways after the initial move, and I wanted an option spread structure that could profit if the SPX lingered around a certain price area. But as always, the market can surprise us, so I’ll show you how I adapted on the fly.

Trade Context and Setup

Initially, the market had bounced (after a dip), and my expectation was that we wouldn’t see a huge, relentless rally within the week. Perhaps that was an overly optimistic assumption, but I wanted a strategy with a relatively muted delta—something that wouldn’t be too hurt if the underlying drifted a bit, but also something that could handle a moderate rise.

I constructed a combination of SPX Calendar and Diagonal spreads around the 5950 strike on the SPX. Why 5950? Because I anticipated the SPX might fill the gap and then stabilize near that level. This setup gave me a balanced risk profile, where time decay could help if the index hovered around my target zone.

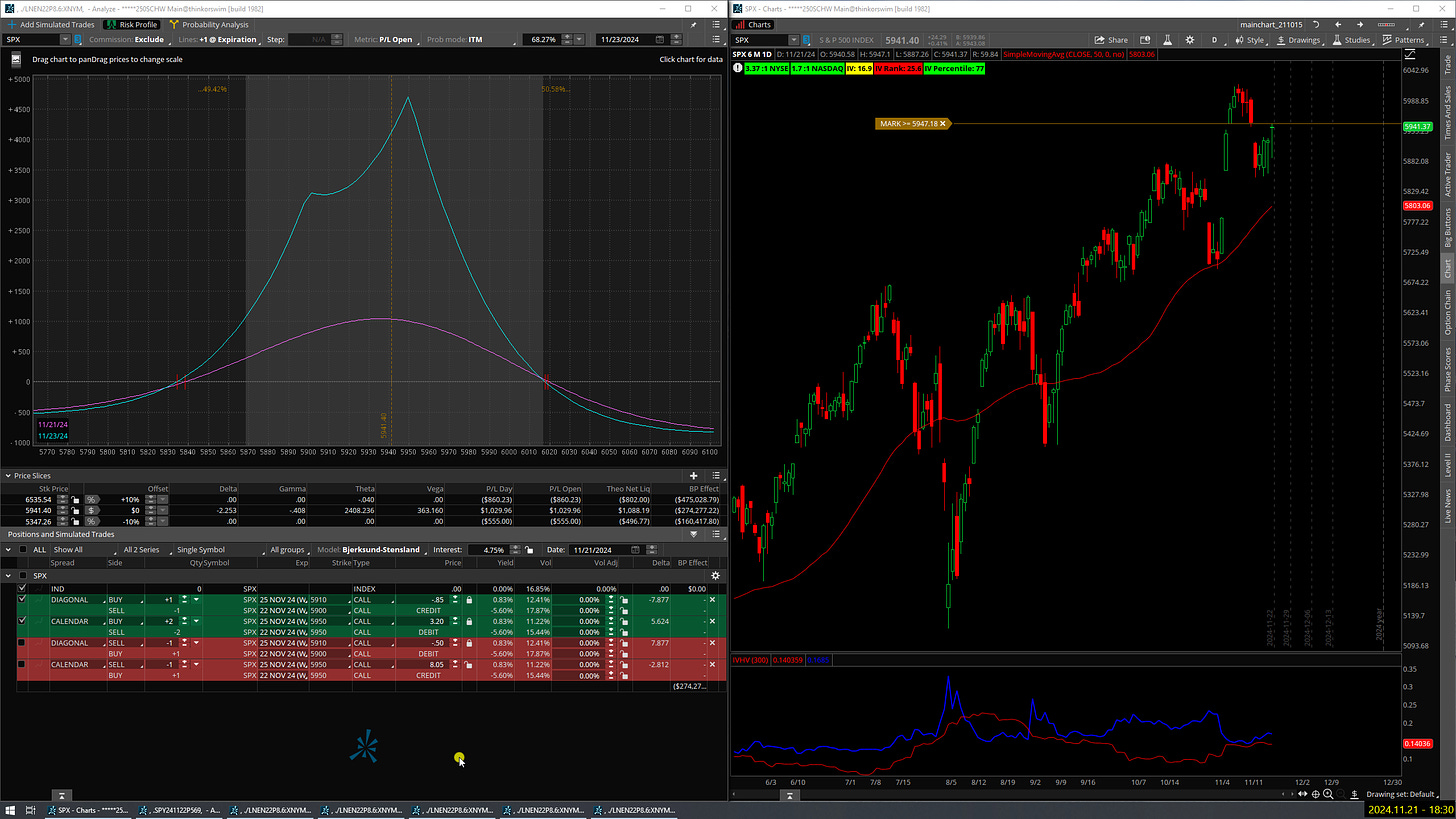

The image above shows the initial risk profile of the Calendar & Diagonal combo around the 5950 strike. You can see how the profit peak aligns near 5950, and the P/L graph gives a good visual of potential outcomes. But be aware, that a time spread’s expiration risk graph tends to mutate as time goes by and volatility changes.

The initial spreads involved selling an 85-cent credit leg (Diagonal) and buying a 3.20 debit leg (Calendar). I left about a 50-point gap the short leg of the Diagonal and the Calendar to allow some price movement without getting crushed if the market moved sharply. But if the market ripped higher, this would not be ideal.

Early Market Action

Shortly after initiating the trade, the market behaved quite erratically: opening lower, then aggressively surging back up, quickly filling the gap I had anticipated. This was a crucial moment: the short leg I had sold near 5910 went deeply in-the-money (ITM) faster than expected. But look at the risk graph, the structure opened up quite nicely. I had a more than $1000 profit on it after only 3 days.

You can see that the lower short options started to become problematic as they moved ITM.

On one of these days (a Thursday), I noticed that the 5910 short leg, which I had initially sold for a credit, was now deeply ITM. At the open, I actually could have closed it at a credit (locking in profit), but I hesitated and ended up closing it later at a 0.5 debit. Not the best outcome, but it was a protective move to avoid carrying an ITM option into expiration, which could have gotten worse.

You should never let an ITM Diagonal run until the very last day of the expiration period. Always close them out 2-3 days before expiration if they are at least 30-50 points ITM.

Adjusting the Position

With the Diagonal portion closed, I was left mainly with my Calendar spreads. The market continued to push higher, demonstrating strong bullish momentum, and soon enough the 5950 area became a launching pad rather than a resting point. A key lesson I’ve learned over the years is that “hope” is expensive. Holding deeply ITM short options into expiration day is often a recipe for disaster. Even if there’s a small chance the market might come back, it’s not usually worth the risk.

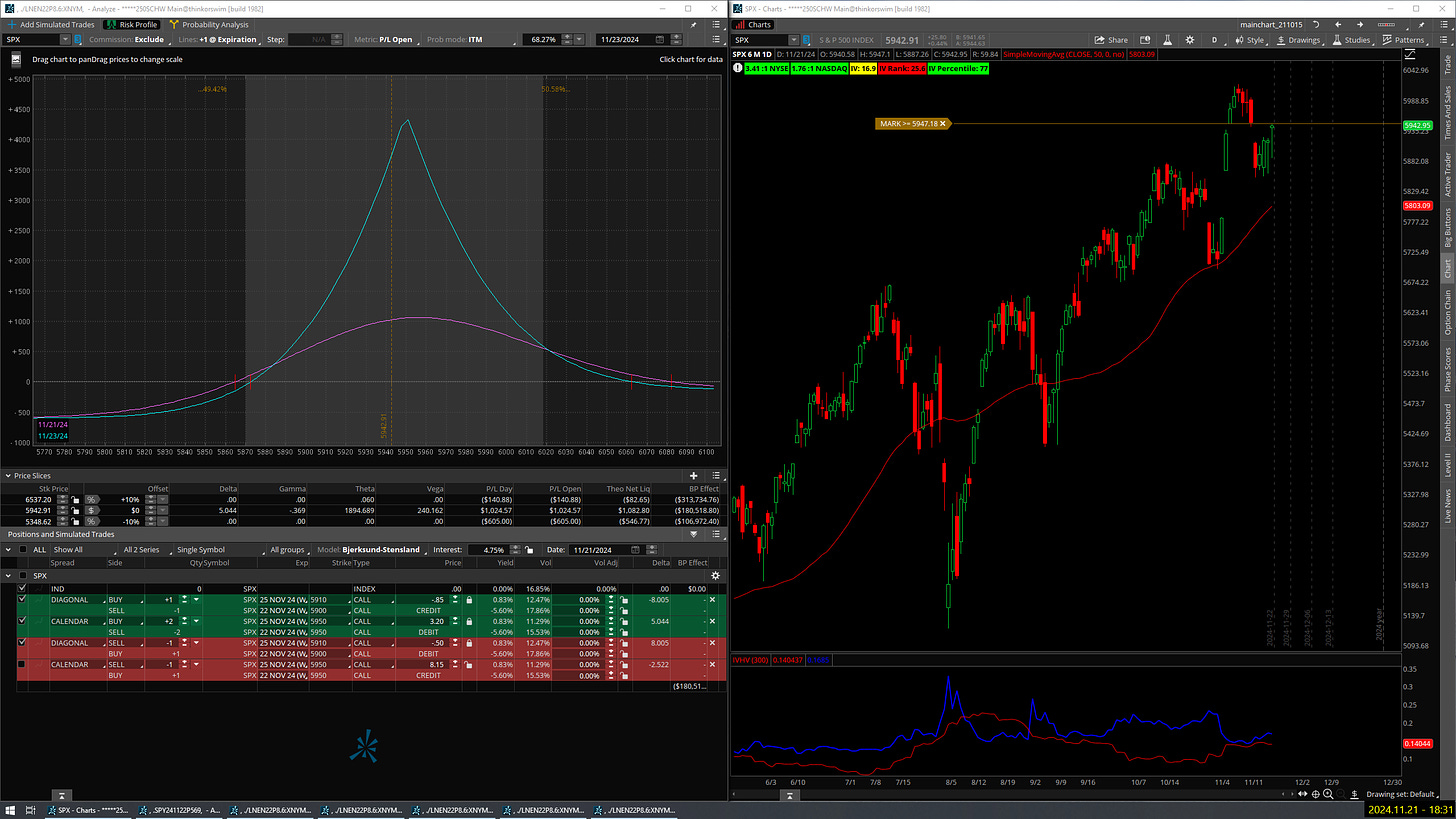

At this stage, I decided to close half of my remaining Calendars at a very favorable price: I bought them at 3.20 initially and sold half at 8.5. This was a great realization of profit, locking in gains as the market environment shifted. This screenshot reflects the partial closing of the Calendars at 8.5, a nice profit considering the initial cost.

By removing the Diagonal and part of the Calendars, I had already locked in a decent profit—around $1,000 or so. Had I not touched the initial Diagonal when it went ITM, I would have seen my overall profit eroded significantly. Seeing how the Diagonal would have dragged the P/L down had I kept it is a reminder of the importance of active management.

The below image illustrates what would have happened if the Diagonal hadn’t been closed. The P/L would be noticeably lower, around $707 instead of over $1,000. This demonstrates that early, proactive adjustments can pay off.

Expiration Day Considerations

Moving into expiration day, I still held half of the Calendars. The SPX was pushing into the 5950s, going deeper ITM relative to my short strikes. At some point, the Calendar structure was still showing a potential for gain if the index hovered near my chosen strike, but if the underlying continued to climb aggressively, the position would start to “sink” due to the nature of being ITM on the short side.

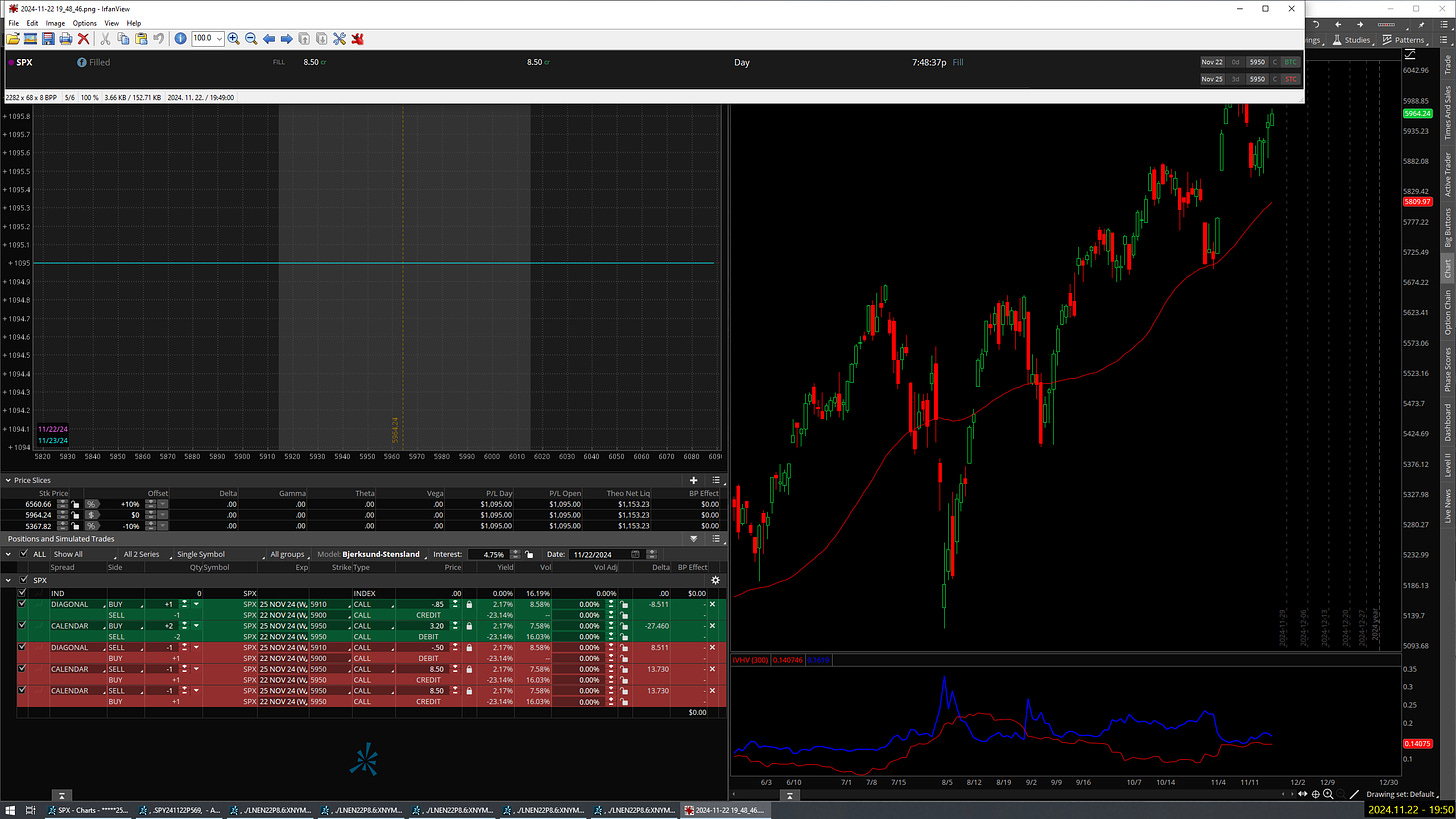

I spent a lot of time babysitting the trade on expiration day, watching if the market would stabilize or continue to surge. Considering my schedule and the unpredictability of the close, I decided to exit the remaining Calendars at the same favorable price (8.5) as I had the first half. This locked in a final profit of about $1,095.

The below image depicts how the P/L evolved when I decided to close the final portion at 8.5. The strategy, which started with a mix of Diagonal and Calendar spreads, ended up netting me a tidy profit even though the market moved much more than I originally anticipated.

Another final snapshot confirming the closing of the remaining Calendars and the final realized profit of $1,095.

Key Takeaways

- Be Flexible and Proactive: My original thesis was that the SPX would fill a gap and stall, but it ended up rallying strongly. By actively managing the trade—closing the Diagonal early and taking partial profits on the Calendar—I preserved and enhanced my overall profit.

- Don’t Cling to ITM Shorts in Hope: Holding ITM options into expiration often hurts more than it helps. When the trade moves significantly beyond your initial assumptions, reducing risk sooner is typically the better decision.

- Partial Closes to Lock in Gains: Taking profit incrementally can improve your outcome. I sold half my Calendar spreads at a nice price (8.5) and then later sold the other half at the same level, which secured a solid profit and avoided last-minute drama.

- Understand the Greeks and Behavior of Calendar/Diagonal Spreads: Calendar and Diagonal spreads can behave quite differently than simple verticals. ITM options, shifts in implied volatility, and sudden directional moves can all influence the P/L profile.

- Hope is Expensive: It’s tempting to hold losing legs in case the market “might” come back. In my experience, that hope often leads to worse outcomes. Cutting underperforming legs before they become anchors can significantly improve your returns.

Sign up below to learn more about options trading.