When a year comes to an end, I like to pause for a moment, look back, and see where we stand. I always review the yearly charts during this period.

Of course, beyond the yearly candles, it’s worth checking the weekly and monthly charts too, just to see the big picture more clearly.

S&P500 – SPX

Let’s start this overview with one of the most important charts in the world, the S&P 500 index—or SPX.

The SPX closed the year up by 23.31%. In 2023, it was 24%, so this year’s performance was very similar to 2023. After a 3-year range, we clearly ended up at a new all-time high. The second half of December saw some gloom after the FOMC meeting, but we did touch the 6100 area briefly.

Nasdaq – NDX

The Nasdaq, representing the tech sector, delivered a very similar yearly performance to the SPX, closing with a 24.88% gain. Of course, this pales in comparison to its 2023 performance, which was an impressive 53%

What still holds true for 2024 is that the bulk of the gains came from the seven major tech giants.

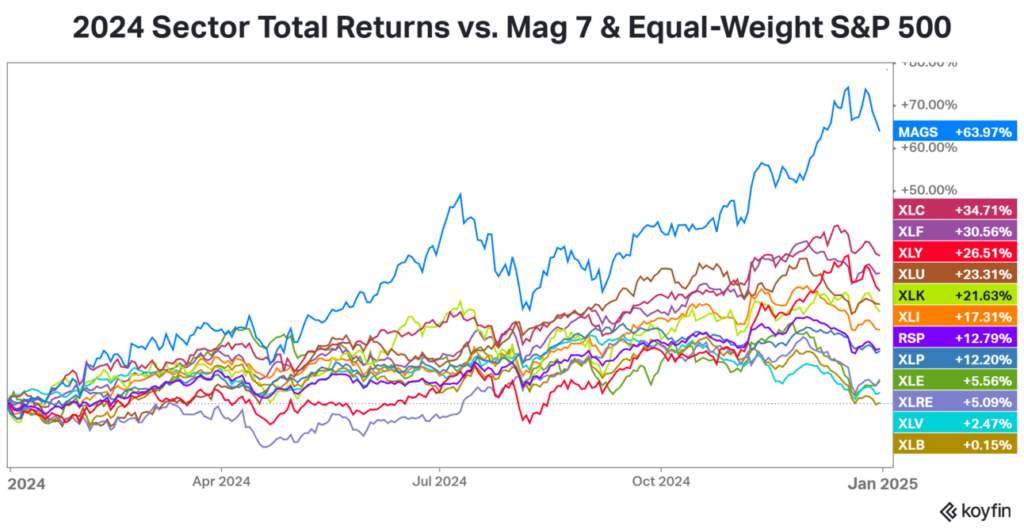

Here’s a chart of the “MAG7” (Magnificent 7) performance—i.e., the biggest tech stocks grouped together.

On this chart, you can also see the RSP, which shows how much the SPX would have moved if every component had the same weighting. This equal-weighted version was up a mere 12.79%.

Using TradingView, I built another chart where I subtracted the eight largest tech stocks from the SPX, just to see how the remaining 492 companies performed. The result is about what we expected—disappointing. On a weekly chart, it would barely be in positive territory.

RUT

The Russell 2000 index (small-cap companies) had a much weaker year compared to the SPX or NDX. One main reason is that the (still high but slowly decreasing) interest rate hit these smaller companies harder. Still, its +10% annual result wasn’t bad, though it’s further away from setting a new high.

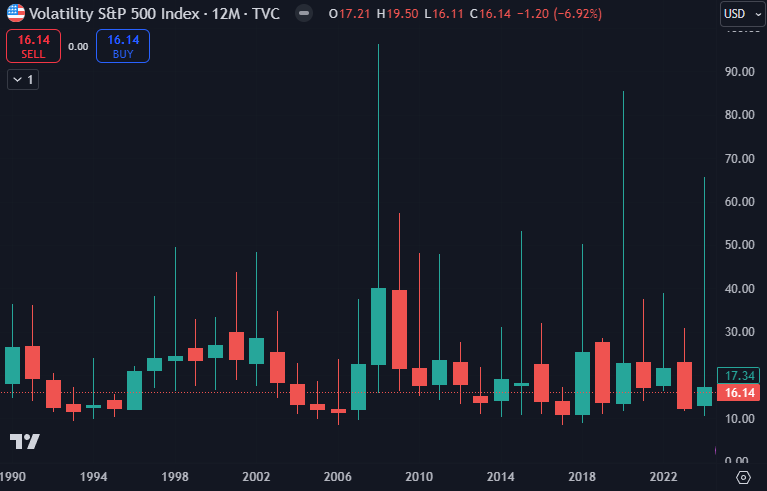

VIX

The fear-and-greed index, the VIX, reached some of its highest levels of the past 15 years—excluding the Covid year. In August, due to the Nikkei scare, the VIX jumped above 65, which is a rare phenomenon.

Dollar index

The dollar index closed the year higher, up +7.05%.

Crude oil

Oil basically did nothing, ending the year almost unchanged.

BTC/USD

The crypto market was pulled higher in the last two months on Trump’s victory. Bitcoin set an absolute new high in 2024, reaching the $108,000 level, a 120% gain.

China

Below is the yearly chart of FXI, the ETF tracking Chinese large caps. After three consecutive down years, China finally managed to close slightly higher this time, +26% on the year.

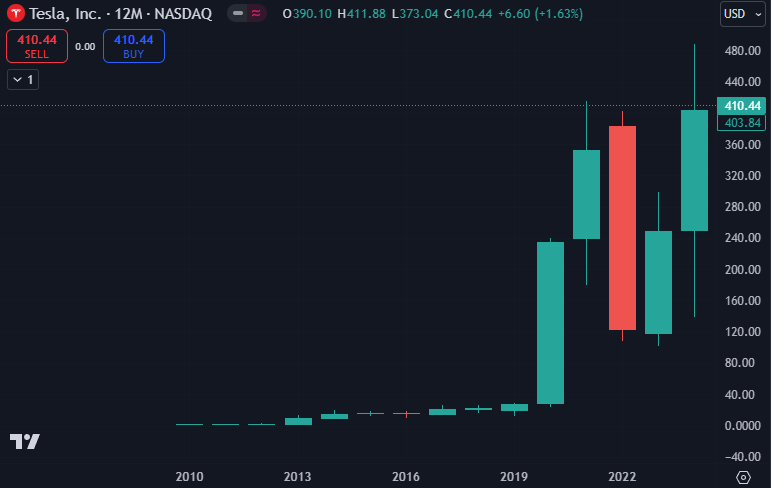

Tesla

Tesla also had a pretty good year, especially following Trump 2.0. It finished up by +62%.

Meta Platforms

Meta had no weak performance either, gaining +65% and hitting an all-time high.

NVDA

One of the biggest winners of the AI revolution kept up its incredible upward streak. While it’s more “modest” compared to its +238% in 2023, it still closed the year at +171%—which is outstanding.

AVGO

Broadcom also caught fire by year-end, riding the AI wave for a +107% increase.

US interest rate

We can’t ignore one of our key charts, the U.S. base rate. In 2024, the Fed cautiously started cutting rates, bringing it down from 5.5% to 4.5%.

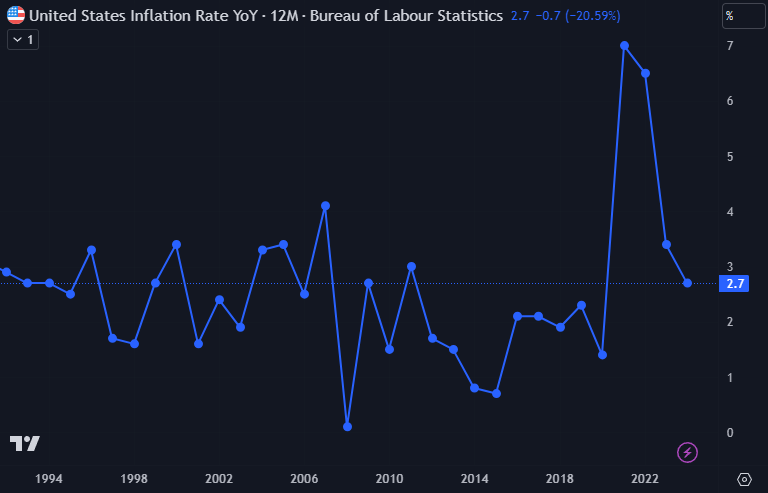

US inflation

U.S. inflation continued to taper off—still plenty of room to fall, of course.

US labor market

The jobless rate crept higher in 2024, which is a recurring concern for the Fed. Yet, the economy remained robust overall.

Other Notable Events in 2024

- AI mania

- Bitcoin surpassing 100K

- Presidential election – Trump 2.0

- Rate-cutting cycle began

- Japanese carry trade crash

- Ongoing Middle East conflicts

- Russia–Ukraine war still drags on

- Elon Musk’s net worth soared above $400 billion 😉

- CrowdStrike outage that temporarily crippled the world

- Boeing challenges and downturn

- Chinese stimulus measures

Looking Ahead to 2025

I’m not into fortune-telling, but here are some factors that might influence the year ahead.

Below is a quick 2025 outlook, bearing in mind that on January 20, Trump will take office again in the United States. As we’ve come to expect, a political power shift can bring changes in many areas, so it’s worth taking a look at what we might expect in the markets.

Monetary Policy Environment

The rate cuts that began in 2024 will likely continue at a slow pace. However, it’s possible Trump will again pressure the Fed for a faster rate-cutting schedule. Lower rates traditionally support the stock market since borrowing becomes cheaper.

Economic Policy and Taxes

A big question is how much Trump will revert to his 2017–2020 approach of strong corporate tax breaks. If more corporate tax cuts are on the table, that could further boost investor sentiment and push the indexes to new highs.

On the other hand, the political process may face new checks and balances (especially if Congress doesn’t line up exactly how he wants), so keep an eye on news regarding potential tax packages, stimulus programs, and infrastructure investments.

Trade War(s)

During Trump’s first term, we saw big tariff hikes and trade restrictions, especially against China. It’s possible we’ll see the U.S.–China skirmishes heat up again in 2025, leading to more volatility—particularly in big American companies that export heavily to China. Add to that the ongoing Middle East conflicts and the Russia–Ukraine war, which could further fuel geopolitical and economic tensions. That means we might see significant swings in certain commodities (oil, gas, metals).

Tech Sector and the AI Frenzy

Tech giants (the MAG7) dominated again in 2024, and I wouldn’t be surprised if they remain a key focus in 2025. We could see another wave of regulatory attempts (sparked by Trump’s rhetoric or antitrust reviews) that might slow certain tech names down.

Meanwhile, AI will likely remain a hot theme, boosting AI chipmakers, cloud providers, and big data companies. But we should be cautious: new government priorities—citing national security, for example—could bring tighter rules on AI exports or data usage.

Inflation and Economic Stimulus

With Trump back in the White House, we could see tax incentives, infrastructure projects, and other stimulus measures. These essentially pump more money into the economy, driving consumer spending and corporate investments. If the economy suddenly gets flooded with too much cash, it might nudge inflation higher—because more money chasing the same amount of goods/services tends to push prices up.

The Fed generally hates that because high inflation poses risks to the economy. If the data shows inflation heating up too quickly, the Fed might slow or halt the rate cuts and take more drastic measures (reducing liquidity or deciding not to cut rates further).

Labor Market and Growth Risks

Data from 2024 suggest the American labor market stayed strong—low unemployment, companies still hiring. But if 2025 brings a sudden shock (like a new geopolitical crisis, a sharp inflation spike, or a financial meltdown somewhere), investor confidence might collapse. That could trigger a rapid economic downturn and stoke recession fears. During a recession, companies lay people off, unemployment climbs, and consumer spending dips. If people are afraid of the future or their income shrinks, they spend less; corporate earnings fall, which can push stock prices down.

Conclusion

2025 promises plenty of fresh developments with Trump’s return to the presidency. The economic landscape will revolve around ongoing rate cuts, inflation trends, and Trump’s economic policies—whether newly introduced or extended.

On top of that, the geopolitical situation hasn’t gotten any less complicated. China, the Middle East, and Russia remain hot zones, keeping commodity prices and market volatility on edge.

All in all, 2025 looks like it’ll be an exciting year. With Trump back, we might just relive the days when his tweets could rock the markets—time to brace ourselves again!

I wish everyone a hugely successful, profitable, and happy new year!